Nj Cash Buyers - Truths

Nj Cash Buyers - Truths

Blog Article

Nj Cash Buyers Can Be Fun For Everyone

Table of ContentsSome Known Facts About Nj Cash Buyers.Top Guidelines Of Nj Cash BuyersWhat Does Nj Cash Buyers Mean?Nj Cash Buyers - Truths

By paying cash money, you lose out on this tax obligation benefit. Having a home outright can leave you with limited fluid possessions available for emergency situations, unanticipated expenses, or other monetary needs. Here are some compelling reasons to take into consideration obtaining a home mortgage rather than paying cash money for a residence:: By securing a mortgage, you have the ability to leverage your financial investment and potentially accomplish higher returns.

Instead of connecting up a considerable amount of money in your home, you can keep those funds readily available for other financial investment opportunities - NJ CASH BUYERS.: By not putting all your available cash money right into a solitary possession, you can maintain an extra diversified financial investment portfolio. Profile diversification is a key threat administration method. Paying money for a home provides various advantages, boosting the percent of all-cash actual estate offers

(https://calendly.com/njcashbuyers07102-proton/30min)The cash money acquisition home procedure requires binding a considerable section of fluid possessions, possibly limiting investment diversity. In contrast, obtaining a mortgage allows leveraging investments, keeping liquidity, and possibly taking advantage of tax obligation advantages. Whether acquiring a house or mortgage, it is crucial to count on a reputable real estate platform such as Houzeo.

Indicators on Nj Cash Buyers You Should Know

With thousands of home listings, is one of the biggest home providing sites in the United States. Yes, you can acquire a residence with cash money, which is much easier and beneficial than using for home mortgages.

Paying cash money for a house locks up a big quantity of your fluid possessions, and limit your economic flexibility. In addition, you miss out on out on tax obligation benefits from mortgage rate of interest reductions and the chance to invest that cash money elsewhere for possibly higher returns. Specialists indicate that also if you have the money to buy a property, you must obtain a mortgage for tax obligation exemptions and far better liquidity.

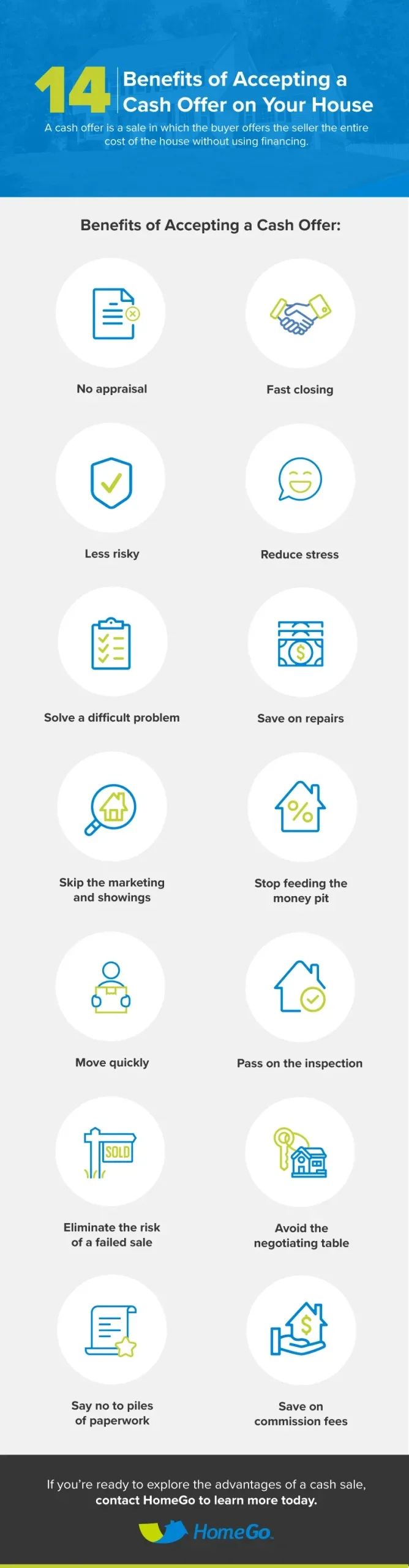

Currently that we've discussed the demand for cash offers in today's realty market, let's explore what they are, who makes them, and their advantages for buyers and sellers. A cash offer in actual estate merely indicates that the buyer does not finance the purchase with a home loan. Typically, the purchaser has the overall sale quantity in their checking account and purchases the house with a check or cable transfer.

In 2023's vendor's market, many purchasers were able to win quotes and save cash on interest thanks to pay offers., which tempts vendors to approve such proposals.

Not known Facts About Nj Cash Buyers

Investor may find the acquisition of rental residential properties with cash to be tempting. Although this approach provides its share of benefits and disadvantages, we will certainly examine them below to allow investors to make an enlightened decision regarding which path is appropriate for them. Cash money purchases of rental buildings supply immediate equity without sustaining home mortgage repayments, giving you instant possession along with monetary adaptability for future investments and expenses.

Money buyers have an edge when bargaining since vendors prefer to collaborate with those that can close swiftly without requiring backups to finance a procurement (cash home buyers in new jersey). This could cause price cuts or favorable terms which enhance profitability for an investment decision. Cash money purchasers do not need to fret about rate of interest fluctuations and the possible repossession threats that go along with leveraged financial investments, making cash acquisitions really feel more secure during economic recessions

The 10-Second Trick For Nj Cash Buyers

By paying cash for a rental home acquisition, you are securing away resources that might otherwise have actually been deployed in other places and generated greater returns. Purchasing with such big sums restrictions liquidity and diversification as well as hinders general portfolio growth. Cash money purchasers frequently ignore the advantages of using other individuals's funds as home mortgages to boost investment returns greatly faster, which could postpone wealth buildup exponentially without leveraged financial investments.

Cash money purchasers could miss out on out on specific reductions that might harm total returns. An investment that includes designating considerable amounts of money towards one property can position focus danger if its performance endures or unexpected problems occur, offering higher security and durability across your portfolio of residential or commercial properties or possession classes.

There has constantly been an affordable advantage to making an all-cash offer, but when home loan prices are high, there's one more: Borrowing money is pricey, and spending for the home in full helps you stay clear of the regular monthly commitment of home mortgage payments and rate of interest. Even more individuals have actually taken this path in recent times, with the percentage of buyers making use of a home loan to buy a home dropping from 87 percent in 2021 to 80 percent in 2023, according to the National Organization of Realtors' latest Account of Home Customers and Sellers. Naturally, the majority of Americans do not have thousands of hundreds of dollars lying around waiting to be spent.

Also if you can afford to purchase a home in cash, should you? Yes, it is feasible and perfectly lawful to buy a home in full, simply as you would a smaller-ticket thing like, state, a layer.

Report this page